What is a balance sheet?

The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement.

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. It incorporates every journal entry since your company launched. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity).

Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position. Companies usually prepare one at the end of a reporting period, such as a month, quarter, or year.

The purpose of a balance sheet

Because the balance sheet reflects every transaction since your company started, it reveals your business’s overall financial health. Investors, business owners, and accountants can use this information to give a book value to the business, but it can be used for so much more.

At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments.

The information in your company’s balance sheet can help you calculate key financial ratios, such as the debt-to-equity ratio, a metric which shows the ability of a business to pay for its debts with equity (should the need arise). Even more immediately applicable is the current ratio: current assets / current liabilities. This will tell you whether you have the ability to pay all your debts in the next 12 months.

You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. You’ll be able to see just how far you’ve come since day one.

Further reading: How to Read a Balance Sheet

A simple balance sheet template

You can download a simple balance sheet template here. You record the account name on the left side of the balance sheet and the cash value on the right.

What goes on a balance sheet

At a high level, a balance sheet works the same way across all business types. They are organized into three categories: assets, liabilities, and owner’s equity.

Assets

Let’s start with assets—the things your business owns that have a dollar value.

List your assets in order of liquidity, or how easily they can be turned into cash, sold or consumed. Bank accounts and other cash accounts should come first followed by fixed assets or tangible assets like buildings or equipment with a useful life longer than a year. Even intangible assets like intellectual properties, trademarks, and copyrights should be included. Anything you expect to convert into cash within a year are called current assets.

Current assets include:

- Money in a checking account

- Money in transit (money being transferred from another account)

- Accounts receivable (money owed to you by customers)

- Short-term investments

- Inventory

- Prepaid expenses

- Cash equivalents (currency, stocks, and bonds)

Long-term assets (or non-current assets), on the other hand, are things you don’t plan to convert to cash within a year.

Long-term assets include:

- Buildings and land

- Machinery and equipment (less accumulated depreciation)

- Intangible assets like patents, trademarks, copyrights, and goodwill (you would list the market value of what fair price a buyer might purchase these for)

- Long-term investments

Let’s say you own a vegan catering business called “Where’s the Beef”. As of December 31, your company assets are: money in a checking account, an unpaid invoice for a wedding you just catered, and cookware, dishes and utensils worth $900. Here’s how you’d list your assets on your balance sheet:

Liabilities

Next come your liabilities—your business’s financial obligations and debts.

List your liabilities by their due date. Just like assets, you’ll classify them as current liabilities (due within a year) and non-current liabilities (the due date is more than a year away). These are also known as short-term liabilities and long-term liabilities.

Your current liabilities might include:

- Accounts payable (what you owe suppliers for items you bought on credit)

- Wages you owe to employees for hours they’ve already worked

- Loans that you have to pay back within a year

- Taxes owed

- Credit card debt

And here are some non-current liabilities:

- Loans that you don’t have to pay back within a year

- Bonds your company has issued

Returning to our catering example, let’s say you haven’t yet paid the latest invoice from your tofu supplier. You also have a business loan, which isn’t due for another 18 months.

Here are Where’s the Beef’s liabilities:

Equity

Equity is money currently held by your company. This category is usually called “owner’s equity” for sole proprietorships and “stockholders’ equity” or “shareholders’ equity” for corporations. It shows what belongs to the business owners and the book value of their investments (like common stock, preferred stock, or bonds).

Owners’ equity includes:

- Capital (the amount of money invested into the business by the owners)

- Private or public stock

- Retained earnings (all your revenue minus all your expenses and distributions since launch)

Equity can also drop when an owner draws money out of the company to pay themself, or when a corporation issues dividends to shareholders.

For Where’s the Beef, let’s say you invested $2,500 to launch the business last year, and another $2,500 this year. You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank.

Here’s a summary of Where’s the Beef’s equity:

The balance sheet equation

This accounting equation is the key to the balance sheet:

Assets = Liabilities + Owner’s Equity

Assets go on one side, liabilities plus equity go on the other. The two sides must balance—hence the name “balance sheet.”

It makes sense: you pay for your company’s assets by either borrowing money (i.e. increasing your liabilities) or getting money from the owners (equity).

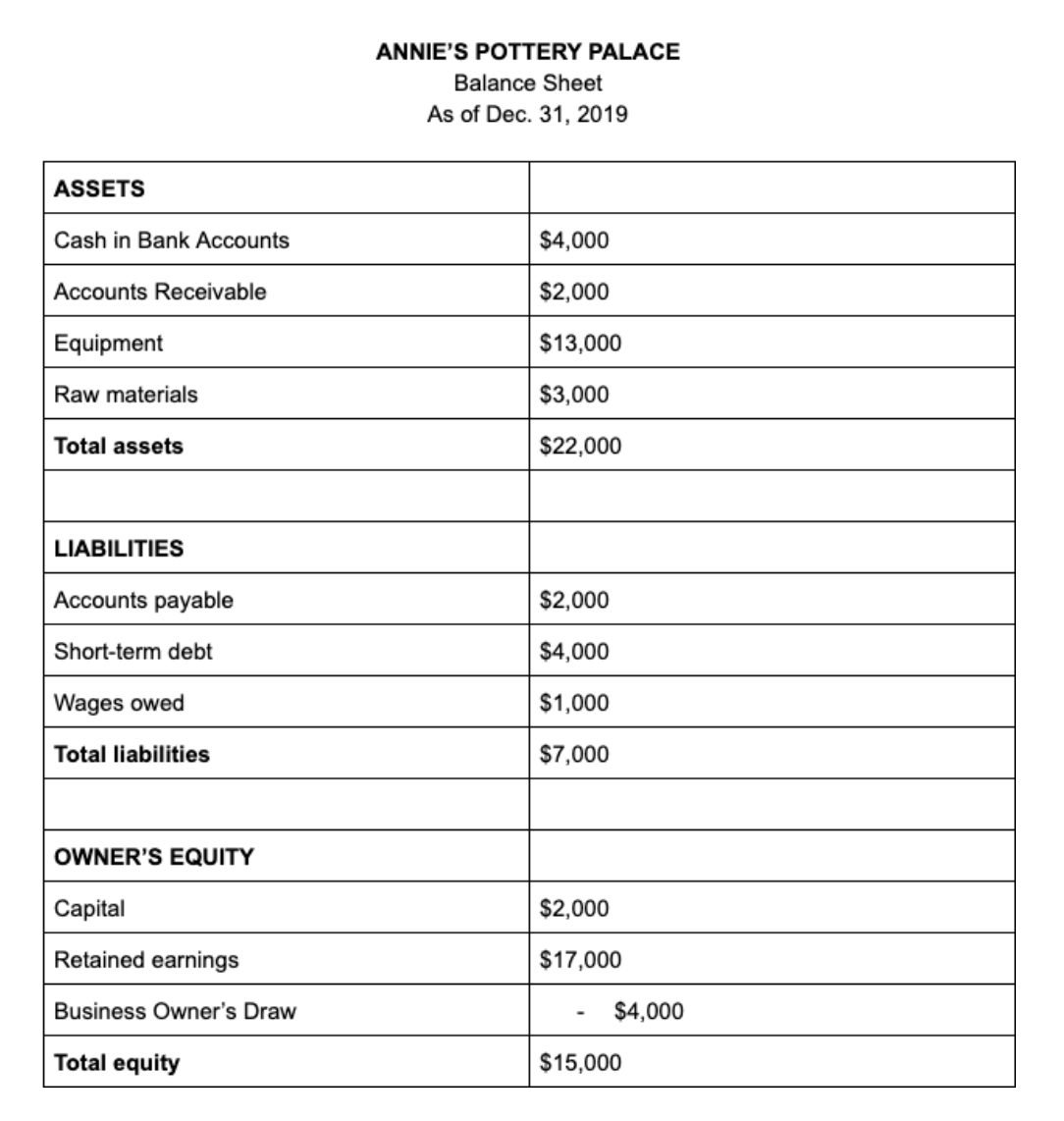

A sample balance sheet

We’re ready to put everything into a standard template (you can download one here). Here’s what a sample balance sheet looks like, in a proper balance sheet format:

Nice. Your balance sheet is ready for action.

Great. Now what do I do with it?

Because the balance sheet reflects every transaction since your company started, it reveals your business’s overall financial health. At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments.

You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. You’ll be able to see just how far you’ve come since day one. If you need help understanding your balance sheet or need help putting together a balance sheet, consider hiring a bookkeeper.

Here’s some metrics you can calculate using your balance sheet:

- Debt-to-equity ratio (D/E ratio): Investors and shareholders are interested in the D/E ratio of a company to understand whether they raise money through investment or debt. A high D/E ratio shows a business relies heavily on loans and financing to raise money.

- Working capital: This metric shows how much cash you would hold if you paid off all your debts. It signals to investors and lenders how capable you are to pay down your current liabilities.

- Return on Assets: A formula for calculating how much net income is being earned relative to the assets owned. The more income earned relative to the amount of assets, the higher performing a business is considered to be.

Next, we’ll cover the three most important ratios that you can calculate using your balance sheet: the current ratio, the debt-to-equity ratio, and the quick ratio.

The current ratio

Can your company pay its debts? The current ratio measures the liquidity of your company—how much of it can be converted to cash, and used to pay down liabilities. The higher the ratio, the better your financial health in terms of liquidity.

The ratio for finding your current ratio looks like this:

Current Ratio = Current Assets / Current Liabilities

You should aim to maintain a current ratio of 2:1 or higher. Meaning, your company holds twice as much value in assets as it does in liabilities. If you had to, you could pay off all the money you owe two times over.

Once you drop below a current ratio of 2:1, your liquidity isn’t looking so good. And if you dip below 1:1, you’re entering hot water. That means you don’t have enough liquidity to pay off your debts.

You can improve your current ratio by either increasing your assets or decreasing your liabilities.

The quick ratio

Also called the acid test ratio, the quick ratio describes how capable your business is of paying off all its short-term liabilities with cash and near-cash assets. In this case, you don’t include assets like real estate or other long-term investments. You also don’t include current assets that are harder to liquidate, like inventory. The focus is on assets you can easily liquidate.

Here’s how you get the quick ratio:

Quick Ratio = (Cash and Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

If your ratio is 1:1 or better, you’re sitting pretty. That means you’ve got enough quick-to-liquidate assets to cover all your short term liabilities in a pinch.

The debt-to-equity ratio

Similar to the current ratio and quick ratio, the debt-to-equity ratio measures your company’s relationship to debt. Only, in this case, the key value is your total equity.

This ratio tells you how much your company depends upon equity to keep running versus how much it depends on outside lenders. It’s calculated like this:

Debt to Equity Ratio = Total Outside Liabilities / Owner or Shareholders’ Equity

Generally speaking, a 2:1 ratio is considered acceptable. If the ratio gets bigger, you start running into trouble. It means your business relies heavily on debt to keep running, which turns off investors. The higher the ratio, the higher the chance that, in the event you need to pay off your debt, you’ll use up all your earnings and cash flows—and investors will end up empty-handed.

Examples of balance sheet analysis

We’ll do a quick, simple analysis of two balance sheets, so you can get a good idea of how to put financial ratios into play and measure your company’s performance.

Summary:

Annie’s Pottery Palace, a large pottery studio, holds a lot of its current assets in the form of equipment—wheels and kilns for making pottery. Accounts receivable play a relatively minor role.

Liabilities are few—a small loan to pay off within the year, some wages owed to employees, and a couple thousand dollars to pay suppliers.

Annie’s is a single-member LLC—there are no shareholders, so her equity includes only her initial investment, retained earnings, and Annie’s draw($4,000).

Ratio analysis:

Current ratio: 22,000 / 7,000 = 3.14:1

Annie’s current ratio is very healthy. If necessary, her current assets could pay off her current liabilities more than three times over.

Quick ratio: 6,000 / 7,000 = 0.85:1

Her quick ratio isn’t looking so hot, though. Annie’s currently sitting just below 1:1, meaning she wouldn’t be able to quickly pay off debt.

Debt-to-equity ratio: 7,000 / 15,000 = 0.46:1

Annie’s debt-to-equity looks good. She’s got more than twice as much owner’s equity than she does outside liabilities, meaning she’s able to easily pay off all her external debt.

Final analysis:

Annie is able to cover all of her liabilities comfortably—until we take her equipment assets out of the picture. Most of her assets are sunk in equipment, rather than quick-to-cash assets. With this in mind, she might aim to grow her easily liquidated assets by keeping more cash on hand in the business checking account.

That being said, her owner’s equity is more than capable of covering her debt, so this problem shouldn’t be difficult to fix. It would be wise for Annie to take care of it before applying for loans or bringing on investors.

Example balance sheet analysis: Bill’s Book Barn LTD.

Summary:

A lot of Bill’s assets are tied up in inventory—his large collection of books. The rest mostly consists of long-term investments and intangible assets. (Bill’s Book Barn is famous among collectors of rare fly-tying manuals; a business consultant valued his list of dedicated returning customers at $10,000.)

He doesn’t have a lot of liabilities compared to his assets, and all of them are short-term liabilities. Meaning, he’ll need to pay off that $17,000 within a year.

Finally, since Bill is incorporated, he has issued shares of his business to his brother Garth. Currently, Garth holds a $12,000 share in the business, a little shy of half its total equity.

Ratio analysis

Current ratio: 30,000 / 17,000 = 1.76:1

Since long-term investments and intangible assets are tough to liquidate, they’re not included in current assets—meaning Bill has $30,000 in assets he can more or less easily use to cover his liabilities. His ratio of 1.76:1 isn’t great—it doesn’t leave much wiggle room if he wants to pay off his liabilities. But it isn’t terrible, either—he’s just shy of a healthy 2:1 ratio.

Quick ratio: 7,000 / 17,000 = 0.41:1

Bill’s quick ratio is pretty dire—he’s well short of paying off his liabilities with cash and cash equivalents, leaving him in a bind if he needs to take care of that debt ASAP.

Debt-to-equity ratio: 17,000 / 15,000 = 1.13:1

Once we take into account his $13,000 owner’s draw, Bill’s owner’s equity comes to just $15,000, shy of his $17,000 in debt. Remember, an acceptable debt-to-equity ratio is 2:1. Bill is falling short of acceptable; if he had to pay off all his debts quickly, his equity wouldn’t cover it, and he’d need to dip into his company’s income. That makes his business unattractive to potential investors. Unless he changes course, Bill will have trouble getting financing for his business in the future.

Summary Analysis

Bill’s ratios don’t look great, but there’s hope. If he starts liquidating some of his long-term investments now, he can bump his current ratio up to 2:1, meaning he’d be in a healthy position to pay off liabilities with his current assets.

His quick ratio will take more work to improve. A lot of Bill’s assets are tied up in inventory. If he could convert some of that inventory to cash, he could improve his ability to pay of debt quickly in an emergency. He may want to take a look at his inventory, and see what he can liquidate. Maybe he’s got shelves full of books that have been gathering dust for years. If he can sell them off to another bookseller as a lot, maybe he can raise the $10,000 cash to become more financially stable.

Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw. Unfortunately, he’s addicted to collecting extremely rare 18th century guides to bookkeeping. Until he can get his bibliophilia under control, his equity will continue to suffer.

—

Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors. But unless you use them in tandem with income statements and cash flow statements, you’re only getting part of the picture. Learn how they work together with our complete guide to financial statements.